Archives

Forget Cloud Computing, Blockchain is the Future

George Gilder Interview with Peter Robinson

The Fed ‘is a god that has failed’

Trump Can Succeed on Trade by Ending Global Currency Manipulation

Leap Before You Look

Reflections on the Mission and "Evolution" of Discovery Institute

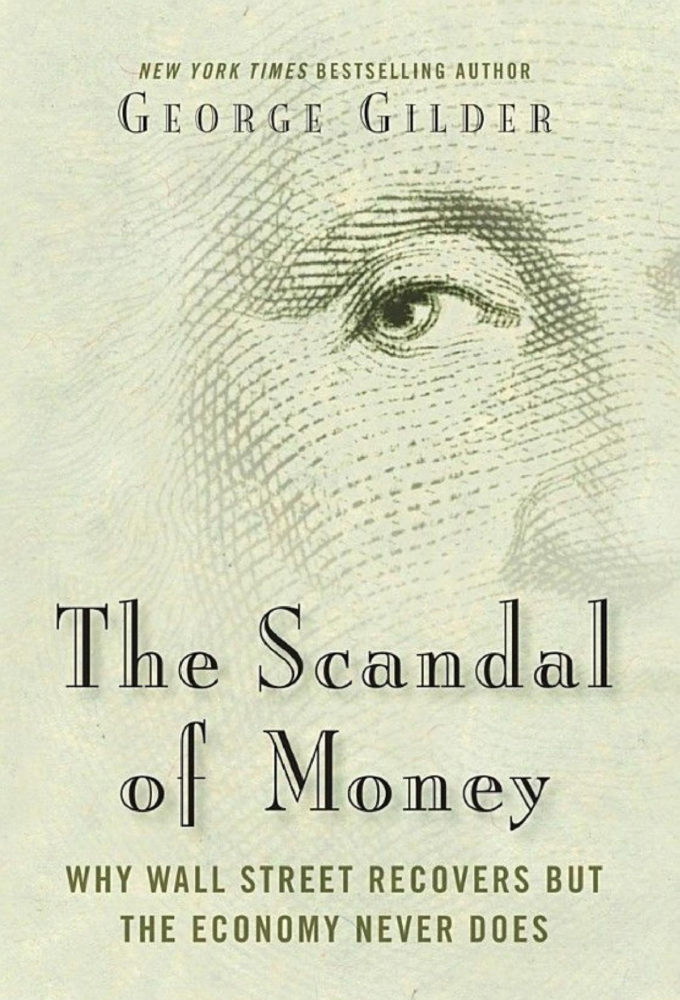

The Scandal of Money

Why Wall Street Recovers but the Economy Never Does

The New Wall Street and the High Cost of Manipulating Money

George Gilder at FreedomFest 2016: The Scandal of Money

Eunuchnet

Transcript: After the Revolution: A Review of the Tech Boom, Bust, and Rebirth

with George Gilder, Hance Haney and Matt McIlwain

Net neutrality: Obama’s FCC puts Internet, American innovation at risk

What Creates Wealth?

George Gilder for Prager University: What Creates Wealth?

Ideas for Renewing American Prosperity

If you could propose one change in American policy, society or culture to revive prosperity and self-confidence, what would it be and why?

Do You Pass the Israel Test?

What is the Impact of Raising Taxes on the Wealthy?

Why Capitalism Works

How do we Spur Innovation and Job Creation? George Gilder, author of Knowledge & Power

The Costs of Health Care Failure